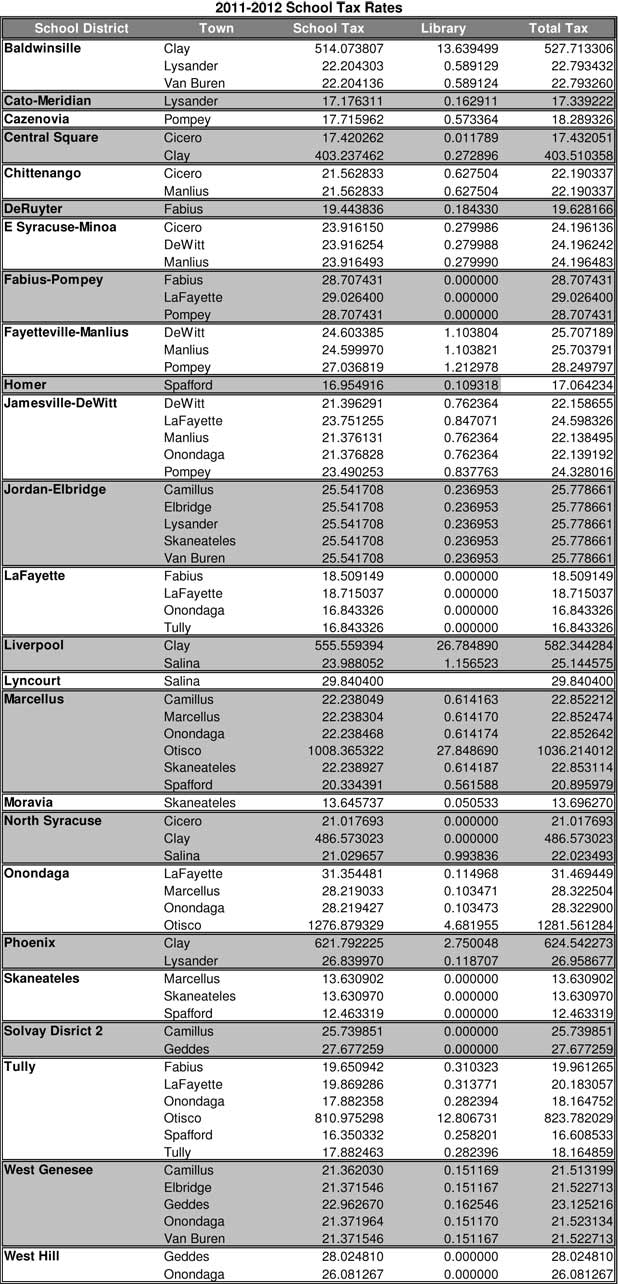

SchoolRates

School Districts Tax Rates

School Tax Receivers | Calculating Tax Rates

All Rates Shown are per $1000 of Assessed Value.

Multiply the total tax rate by the assessed value of a parcel then divide by 1,000.

This information is provided for estimation purposes only. We do not guarantee the accuracy of the rates.

It is possible that in the process of transferring the information to the website, errors may have occurred

ALL School Tax Rates PDF (2012-13 Taxes to Present)

School District Town ’17-18 School Rate Library Rate Total Tax Rate Baldwinsville Clay 557.071095 14.683067 571.754162 Lysander 23.889336 0.629687 24.519023 Van Buren 23.889839 0.629679 24.519518 Cato-Meridian Lysander 17.607433 0.151994 17.759427 Cazenovia Pompey 17.741872 0.557332 18.299204 Central Square Cicero 18.899288 0.034356 18.933644 Clay 440.528984 0.800819 441.329803 Chittenango Cicero 21.780923 0.665437 22.446360 Manlius 21.780923 0.665437 22.446360 DeRuyter Fabius 18.800894 0.200912 19.001806 E Syracuse-Minoa Cicero 24.686630 0.294964 24.981594 Dewitt 24.686732 0.294967 24.981699 Manlius 24.686292 0.294960 24.981252 Fabius-Pompey Fabius 26.132617 26.132617 LaFayette 27.818585 27.818585 Pompey 26.132617 26.132617 Fayetteville-Manlius Dewitt 25.624873 1.331276 26.956149 Manlius 25.625299 1.331298 26.956597 Pompey 25.883932 1.344734 27.228666 Homer Spafford 19.626292 0.136291 19.762583 Jamesville-Dewitt Dewitt 23.245832 0.853577 24.099409 LaFayette 24.995100 0.917825 25.912925 Manlius 23.245443 0.853577 24.099020 Onondaga 23.245757 0.853577 24.099334 Pompey 23.480246 0.862199 24.342445 Jordan-Elbridge Camillus 25.728421 0.346848 26.075269 Elbridge 25.728541 0.346850 26.075391 Lysander 25.728420 0.346848 26.075268 Skaneateles 25.728420 0.346848 26.075268 Van Buren 25.728420 0.346848 26.075268 Lafayette Fabius 18.628736 18.628736 LaFayette 19.830708 19.830708 Onondaga 18.442448 18.442448 Tully 18.442495 18.442495 Liverpool Clay 641.380069 28.686053 670.066122 Salina 27.504224 1.230141 28.734365 Lyncourt Salina 31.622040 0.377726 31.999766 Marcellus Camillus 23.913370 0.660877 24.574247 Marcellus 23.913642 0.660885 24.574527 Onondaga 23.913801 0.660889 24.574690 Otisco 1186.303162 32.785041 1219.088203 Skaneateles 23.914391 0.660906 24.575297 Spafford 23.913971 0.660894 24.574865 Moravia Skaneateles 14.772130 0.089329 14.861459 North Syracuse Cicero 23.652310 23.652310 Clay 551.538088 551.538088 Salina 23.658519 1.218558 24.877077 Onondaga LaFayette 30.563403 0.169417 30.732820 Marcellus 28.423965 0.157558 28.581523 Onondaga 28.424214 0.157558 28.581772 Otisco 1407.126980 7.799902 1414.926882 Phoenix Clay 644.385687 2.752254 647.137941 Lysander 27.633026 0.117983 27.751009 Skaneateles Marcellus 14.443794 0.210550 14.654344 Skaneateles 14.443862 0.210551 14.654413 Spafford 14.443879 0.210551 14.654430 Solvay Camillus 28.432387 0.084153 28.516540 Geddes 30.894748 0.077421 30.972169 Tully Fabius 21.243545 0.379024 21.622569 LaFayette 22.614097 0.403477 23.017574 Onondaga 21.031110 0.375234 21.406344 Otisco 1042.291946 18.596418 1060.888364 Spafford 21.034005 0.375286 21.409291 Tully 21.031242 0.375236 21.406478 West Genesee Camillus 23.312701 0.331351 23.644052 Elbridge 23.329837 0.331349 23.661186 Geddes 25.878380 0.368171 26.246551 Onondaga 23.330172 0.331353 23.661525 Van Buren 23.329837 0.331349 23.661186 West Hill Geddes 31.211391 0.284766 31.496157 Onondaga 28.106370 0.256291 28.362661

527.509645 13.823454 541.333099

22.784616 0.597074 23.381690

22.784407 0.597068 23.381475

17.267788 0.100403 17.368191

17.726712 0.567210 18.293922

354.277584 0.247024 354.524608

401.674202 0.280072 401.954274

424.324376 12.768191 437.092567

20.791894 0.625641 21.417535

19.090503 0.159750 19.250253

482.750473 5.758186 488.508659

23.654910 0.282154 23.937064

23.655181 0.282156 23.937337

28.063062 0.000000 28.063062

27.459555 0.000000 27.459555

28.063062 0.000000 28.063062

24.307944 1.018343 25.326287

24.301814 1.018358 25.320172

26.712027 1.119059 27.831086

17.982670 0.116619 18.099289

20.745804 0.739141 21.484945

22.307148 0.794775 23.101923

20.745649 0.739141 21.484790

20.746352 0.739141 21.485493

22.797415 0.812243 23.609658

24.320684 0.236664 24.557348

24.320925 0.236666 24.557591

24.320684 0.236663 24.557347

24.320684 0.236663 24.557347

24.321731 0.236673 24.558404

18.681102 0.000000 18.681102

18.279359 0.000000 18.279359

16.999804 0.000000 16.999804

16.999797 0.000000 16.999797

545.911023 26.676719 572.587742

23.571476 1.151854 24.723330

28.130129 0.000000 28.130129

21.300277 0.611206 21.911483

21.300521 0.611213 21.911734

21.300479 0.611212 21.911691

974.647653 27.967269 1002.614922

21.300277 0.611206 21.911483

21.301891 0.611252 21.913143

12.288876 0.046350 12.335226

420.344374 0.000000 420.344374

476.480295 0.000000 476.480295

20.591815 1.075557 21.667372

30.048570 0.092041 30.140611

27.945171 0.085598 28.030769

27.945562 0.085599 28.031161

1276.035183 3.908598 1279.943781

607.177419 1.777262 608.954681

26.208787 0.076715 26.285502

13.120000 0.000000 13.120000

13.120033 0.000000 13.120033

13.120221 0.000000 13.120221

24.166579 0.000000 24.166579

25.986241 0.000000 25.986241

19.254393 0.293793 19.548186

18.840320 0.287474 19.127794

17.521497 0.267351 17.788848

801.849394 12.234992 814.084386

17.521497 0.267351 17.788848

17.521601 0.267353 17.788954

20.620853 0.101713 20.722566

20.630365 0.101712 20.732077

22.156248 0.109368 22.265616

20.630771 0.101714 20.732485

20.630365 0.101712 20.732077

27.416610 0.000000 27.416610

25.510376 0.000000 25.510376

528.705010 13.916085 542.621095

22.836235 0.601074 23.437309

22.835888 0.601065 23.436953

17.378217 0.103495 17.481712

16.215858 0.523760 16.739618

337.213008 0.246740 337.459748

382.326001 0.279749 382.605750

406.216451 12.463194 418.679645

19.904606 0.610697 20.515303

18.823042 0.160604 18.983646

476.751398 3.965758 480.717156

23.360954 0.194324 23.555278

23.361225 0.194326 23.555551

27.390558 0.000000 27.390558

25.434091 0.000000 25.434091

27.390559 0.000000 27.390559

23.885790 0.924644 24.810434

23.882444 0.924658 24.807102

26.248121 1.016092 27.264213

17.320095 0.114858 17.434953

20.438279 0.720726 21.159005

20.855387 0.735435 21.590822

20.438278 0.720726 21.159004

20.438280 0.720726 21.159006

22.459648 0.792007 23.251655

23.927464 0.210674 24.138138

23.927702 0.210676 24.138378

23.927464 0.210674 24.138138

23.927464 0.210674 24.138138

23.928496 0.210683 24.139179

19.283785 0.000000 19.283785

17.906373 0.000000 17.906373

17.548246 0.000000 17.548246

17.548246 0.000000 17.548246

536.391614 26.509155 562.900769

23.160423 1.144618 24.305041

27.539400 0.000000 27.539400

20.855462 0.613343 21.468805

21.066367 0.619546 21.685913

20.855663 0.613349 21.469012

954.279700 28.064647 982.344347

20.855462 0.613343 21.468805

20.857040 0.613390 21.470430

12.276710 0.047920 12.324630

409.068304 0.000000 409.068304

463.971498 0.000000 463.971498

20.039081 0.993836 21.032917

28.515482 0.088503 28.603985

28.227447 0.087609 28.315056

27.945569 0.086734 28.032303

1276.035257 3.960406 1279.995663

592.045411 1.772285 593.817696

25.576362 0.076563 25.652925

12.958632 0.000000 12.958632

12.829126 0.000000 12.829126

12.829260 0.000000 12.829260

24.095627 0.000000 24.095627

25.909871 0.000000 25.909871

18.899981 0.282276 19.182257

17.549982 0.262113 17.812095

17.198983 0.256871 17.455854

787.052403 11.754813 798.807216

17.198983 0.256871 17.455854

17.198983 0.256871 17.455854

20.294598 0.103032 20.397630

20.302844 0.103031 20.405875

21.807921 0.110786 21.918707

20.303249 0.103033 20.406282

20.303338 0.103033 20.406371

26.997770 0.000000 26.997770 Onondaga 25.112802 0.000000 25.112802

2008 – 09 School Tax Rates

2007-08 School Tax Rates

2007-08 School Tax Rates

Onondaga County provides this information with the understanding that it is not guaranteed to be accurate, correct, current or complete. Conclusions drawn from this information are the responsibility of the user. Appropriate agencies should be contacted to verify this information. While every reasonable effort has been made to ensure the timeliness and accuracy of the information, Onondaga County takes no responsibility for errors and omissions. Onondaga County shall not be liable under any circumstances for any claims or damages arising directly or indirectly from information presented herein.

The information obtained from this web site shall not be used for any unlawful purpose. Several categories of information are automatically collected from users and stored in a log file. if necessary, this information can be retrieved and analyzed. Article 156 of the New York state penal law regarding offenses involving computers states that a person is guilty of computer trespass when he knowingly uses a computer or computer service with the intent to commit or attempt to commit or further the commission of any felony. Computer trespass is a class e felony, punishable by a minimum of 3 years and a maximum of 4 years in prison.